The Engulfing Candlestick Pattern is a two-candle formation in technical analysis that suggests a potential reversal in market direction. It is a reversal pattern that occurs after a prevailing trend, whether upward or downward, and is known for its distinctive visual appearance where one candle completely engulfs the body of the preceding candle.

There are two variations of the Engulfing Pattern: Bullish Engulfing and Bearish Engulfing. In this article, we will discuss about the Bullish Engulfing Pattern.

Bullish Engulfing Candlestick Pattern

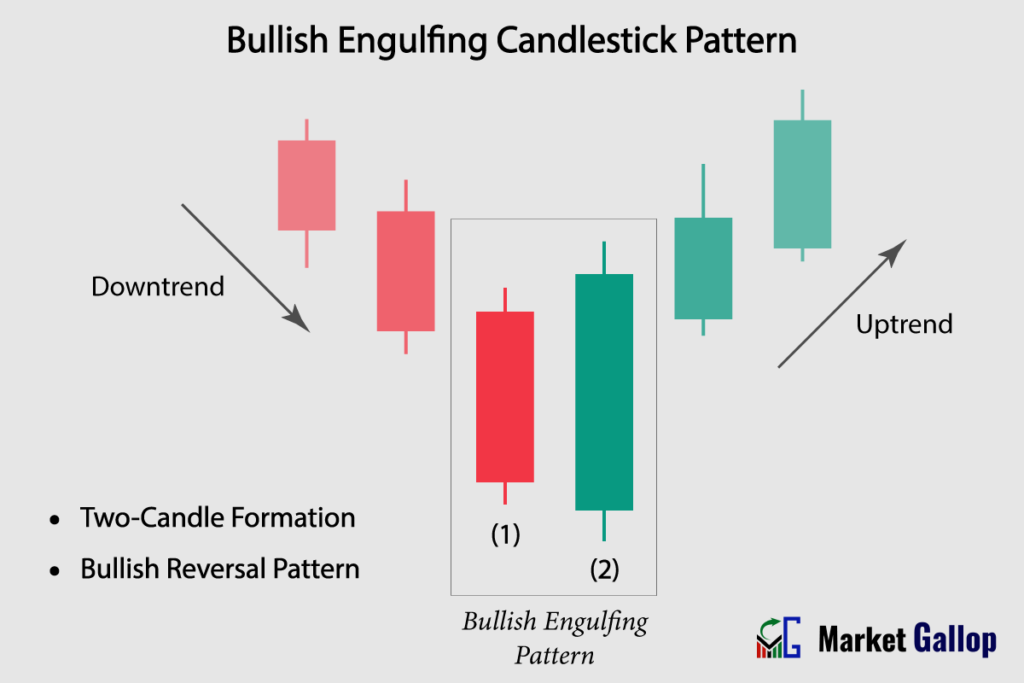

The Bullish Engulfing Candlestick Pattern is a two-day candle pattern that often indicates a potential bullish reversal in a downtrend.

It’s formed when a small bearish candlestick is followed by a larger bullish candlestick that completely engulfs the previous candle’s body. This pattern indicates the possibility of a shift in market sentiment from bearish to bullish.

Bullish Engulfing Pattern – Formation

Bullish Engulfing pattern is a two-candle reversal formation.

First Candlestick (Bearish): The first candle is a bearish (red) candlestick with a small body. This candle indicates that sellers were in control during the session, pushing prices lower.

Second Candlestick (Bullish): The second candle is a bullish (green) candlestick with a larger body than the first candle. The entire body of the second candle “engulfs” the body of the first candle.

Rules of Identification

Prior Trend: The market should be in a clear downtrend before the Bullish Engulfing pattern occurs.

First Candle: The first candle should be a bearish (red) candlestick

Second Candle: The second candle should be a bullish (green) candlestick with a larger real body than the first candle. The real body of the second candle should completely engulf the real body of the first candle.

Color: The color of the first candle must be red, and the second candle must be green.

Shadows: The primary focus of the pattern is on the candle bodies. Small shadows are not important.

Market Psychology

The first candle of the Bullish Engulfing pattern represents a bearish sentiment. The second candle, which is larger and bullish, is where the psychological shift occurs.

The Bullish Engulfing pattern suggests a potential reversal in the current downtrend and the emergence of a new uptrend. It signifies that buyers have become more dominant, overwhelming the previous selling pressure. Traders often interpret this pattern as a signal to enter long (buy) positions or to close short (sell) positions.

How to Trade Bullish Engulfing Pattern

- Identify the Downtrend: Before looking for Bullish Engulfing patterns, make sure there is a clear and established downtrend in the price chart.

- Wait for a Bullish Engulfing Pattern to Emerge: Wait for the completion of candles 1 and 2.

- Entry: Once the pattern is confirmed, observe the behavior of the 3rd candle. Once the 3rd candle breaches the highest high of candles 1 & 2, the entry is triggered. However, more conservative traders should wait for the close of the 3rd candle. If the close of the 3rd candle is above the highest high of candles 1 & 2, the entry is confirmed.

- Set Stop-Loss: Traders may set stop-loss below the lowest low of candles 1 and 2.

Traders should consider using additional technical analysis tools, such as key support levels, trendlines, and technical indicators, to confirm the validity of the pattern.

Trigger: When the third candle’s price breaches the high of the engulfing candle.

Confirmation: The third candle should close above the high the entire engulfing pattern.

Stop-loss: Just below the low of the entire engulfing pattern.

Reliability of the Pattern

The Bullish Engulfing pattern is more reliable when it appears after a prolonged downtrend, indicating a potential trend reversal. Its reliability increases when the pattern forms near key support levels.

While the Bullish Engulfing pattern suggests a potential bullish reversal, it’s important to note that not all instances will lead to a substantial trend change. Often it may lead to only short-term reversals or minor retracements within a larger downtrend.

Bullish Engulfing patterns appearing on higher timeframes (weekly or monthly) are more reliable. Combining the pattern with other technical analysis tools can help increase its effectiveness as a trading signal.

Gallop Insights

Combining the Bullish Engulfing pattern with other technical analysis tools can enhance the accuracy of trading decisions.

For better results:

- Look for Bullish Engulfing pattern at key levels (support & resistance levels)

- Wait for confirmation of pattern, i.e., till the close of 3rd candle.

- It should be used in combination with other technical analysis tools and indicators.