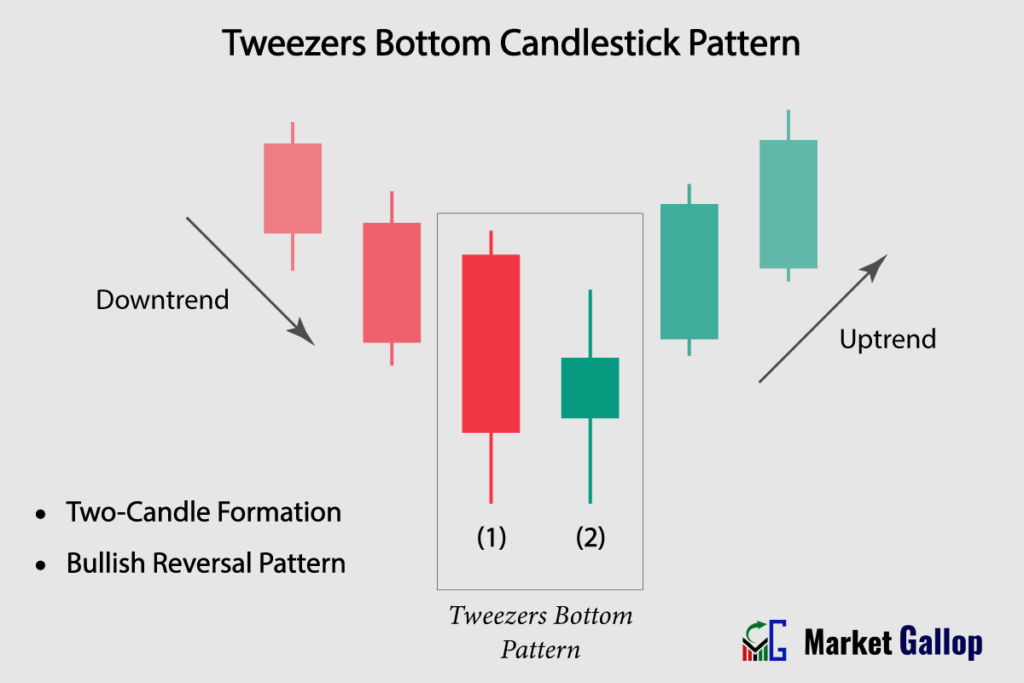

The Tweezers Bottom pattern often forms at the end of a downtrend, providing traders with an early indication of a potential trend reversal. Catching a trend reversal early can result in favorable entry points and improved risk-reward ratios.

Tweezers Bottom Candlestick Pattern

The Tweezers Bottom candlestick pattern is a two-day candle formation that emerges at the end of a downtrend, indicating a possible shift from bearish to bullish momentum.

This pattern is characterized by two or more candlesticks with identical or nearly identical low prices. The consecutive identical lows suggest that selling pressure may be weakening, and buyers might be stepping in to support the price.

Tweezers Bottom Pattern – Formation

The Tweezers Bottom pattern is a two-candle reversal formation.

First Candlestick (Generally Bearish): Typically, the first candle is a bearish (red) candlestick with a lower shadow. However, in rare cases, it can also be a doji candle or a bullish (green) candle with a lower shadow. The presence or absence of upper shadows does not matter. This candle indicates that while the market sentiment remains negative, buyers are present at lower price levels.

Second Candlestick (Bearish, Bullish or a Doji): The second candle can be a bearish (red), bullish (green) or a doji candle as long as it’s low is at the same level as the first candle’s low. This candle indicates the inability of sellers to push prices lower than the previous low and the continued presence of buyers at lower price levels.

Possibility of Additional Candlesticks: In some instances, there can be more than two candles. The validity of the pattern exists as long as the lows of such additional candles are at the same levels as the first two candles.

Rules of Identification

Prior Trend: The market should be in a clear and prolonged downtrend before the Tweezers Bottom pattern occurs.

First Candle: The first candle is typically a bearish (red) candlestick and in rare instances, a bullish (green), or a doji candle.

Second Candle: The low of the second candle should match or closely match the low of the first candle. The second candle can be a bearish (red), bullish (green), or a doji candle, as long as its low is at the same level as the low of the first candle.

Additional Candles: The lows of multiple candles, if any, should match the lows of candles 1 and 2.

Color: The color of the first candle is red most of the time; however, in some instances, it is green. The color of the second candle does not matter.

Shadows: The primary focus of the pattern is on the candle lows. The presence or absence of shadows does not matter. However, the lows of the candles should be at the same level.

Market Psychology

The first candle, often bearish (red), signals an existing negative sentiment in the market. This implies that sellers have been dominant, resulting in a downward movement in prices. However, the lower shadow of the candle reveals the presence of buyers at lower price levels. This suggests that even in the midst of bearish sentiment, there are investors or traders who see value in buying at these lower levels.

The low of the second candle matches the low of the first candle, indicating that sellers were unable to push prices any lower than what was achieved with the first candle. This lack of progress by sellers suggests a weakening in their influence or possibly a lack of conviction. Importantly, it also highlights the continued interest of buyers at the same lower price levels.

Collectively, these characteristics – the inability of sellers to extend the downward movement and the presence of buyers willing to step in at those levels – point toward the possibility of a change in market sentiment.

How to Trade Tweezers Bottom Pattern

- Identify the Downtrend: Before looking for Tweezers Bottom pattern, make sure there is a clear and established downtrend in the price chart.

- Wait for a Tweezers Bottom Pattern to Emerge: Wait for the completion of candles 1 and 2. In some instances, more than two candles may exhibit the same behavior (i.e., more than two candles with lows at the same level).

- Entry: Once the pattern is confirmed, observe the behavior of the subsequent candles. Entry is triggered when the highest high of candles 1 & 2 (or additional candles with the same low) is breached. However, more conservative traders should wait for subsequent candles to close. Entry is confirmed when a subsequent candle closes above the highest high of candles 1 & 2 (or additional candles with the same low).

- Set Stop-Loss: Traders may set stop-loss below the lowest low of candles 1 and 2 (or additional candles with same low).

In order to validate the potential reversal indicated by the Tweezers Bottom pattern, traders frequently incorporate additional technical analysis tools. These can include key support levels, trendlines, volume analysis, and technical indicators. This approach helps mitigate the risk of false signals and enhances the overall reliability of the pattern.

Trigger: When the price of subsequent candles breaches the high of the entire Tweezers Bottom pattern.

Confirmation: Subsequent candles must close above the high the entire Tweezers Bottom pattern.

Stop-loss: Just below the low of the entire Tweezers Bottom pattern.

Reliability of the Pattern

The pattern’s formation near a crucial support level can enhance the probability of a bullish reversal. The pattern is more reliable when it forms at the end of a sustained downtrend.

Patterns appearing on higher timeframes (weekly or monthly) are more reliable. When validated by other technical analysis tools, the pattern becomes more effective.

Gallop Insights

For better results:

- Look for Tweezers Bottom pattern at key levels (support & resistance levels)

- Wait for confirmation of the pattern, i.e., the close of a subsequent candle above the highest high of the pattern.

- It should be used in combination with other technical analysis tools and indicators.