Blue chip stocks are shares of large, well-established companies with a history of stable earnings, strong financials, and a solid reputation in their respective industries. These companies are typically leaders in their sectors, have a long track record of success, and often pay dividends to shareholders. Blue chip stocks are often favored by conservative investors seeking to preserve capital and generate steady returns over the long term.

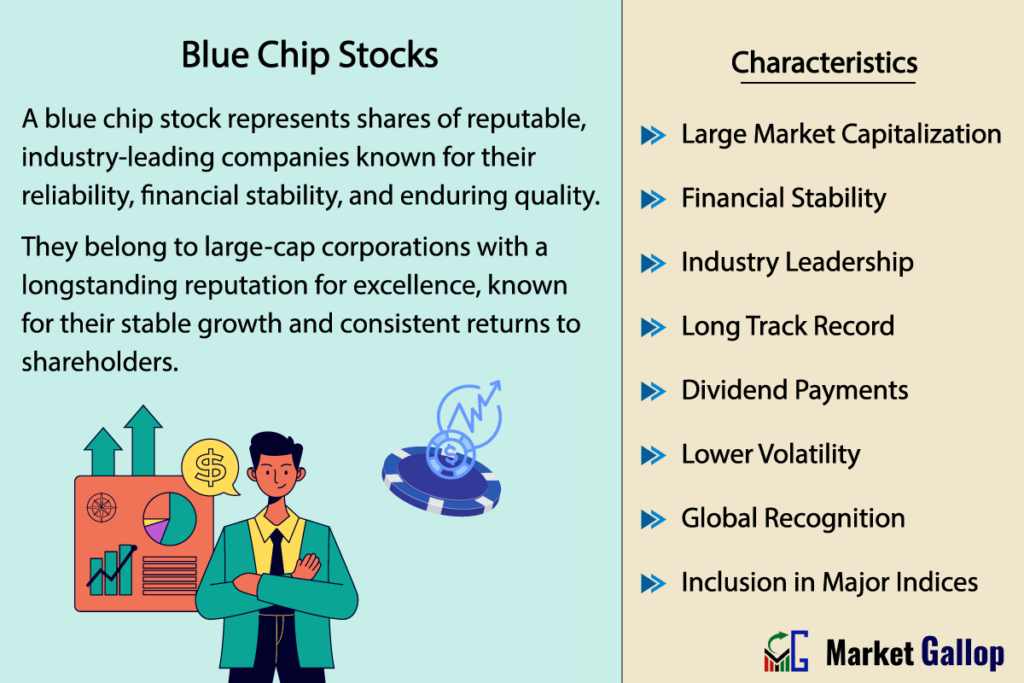

What is a Blue Chip Stock?

A blue chip stock refers to shares of a well-established, financially sound, and reputable company with a history of stable earnings, strong balance sheets, and a leading position in its industry. These companies are recognized for their reliability and stability and often have a long track record of consistent dividend payments.

The term “blue chip” originated from poker, where blue chips traditionally represent the highest value. Blue chip stocks are considered safe investments offering steady returns, and hence conservative investors seeking stability and lower risk often prefer to invest in these stocks. Examples of blue chip stocks include companies like Apple, Microsoft, and Johnson & Johnson.

As previously mentioned, blue chip stocks are especially well-suited for conservative investors who prioritize capital preservation and consistent returns. These investors have a lower risk tolerance and seek investments that offer stability and reliability. Blue chip stocks align well with their investment objectives as they tend to exhibit lower volatility compared to smaller or riskier stocks. Additionally, dividend-paying blue chip companies are suitable for income-oriented investors, such as retirees or those seeking passive income.Top of Form

On the other hand, investors seeking high-growth opportunities and willing to take on higher levels of risk may find blue chip stocks less appealing. This is because these stocks are known not only for their stability but also for their slower growth compared to smaller, high-growth stocks. However, there are exceptions-instances where blue chip stocks exhibit strong growth potential. For example, Nvidia (NVDA) stock in recent years.

Nvidia is usually considered a blue chip stock due to its large market capitalization, industry leadership in graphics processing units (GPUs) and artificial intelligence (AI) technology, and inclusion in major market indices like the S&P 500. In recent years, it has experienced periods of rapid growth, with its stock price outperforming broader market indices and attracting investors seeking exposure to high-growth technology companies. However, it’s worth noting that some analysts do not consider Nvidia a true blue chip stock, primarily due to its high volatility.

Despite the perceived lower growth potential of blue chip stocks, risk-tolerant investors also often invest in them as part of portfolio diversification strategies. Including these stocks in a diversified portfolio can help offset the higher risk associated with high-growth stocks present in the portfolio. Additionally, blue chip stocks often pay regular dividends, providing investors with a source of passive income and enhancing the total return of the portfolio over time.

There is no official list of criteria to identify blue chip stocks; instead it is a widely adopted term used to refer to large, well-established, and financially stable companies with a history of consistent performance and market leadership. Different financial analysts and market commentators put forward different benchmarks to determine them. However a blue chip stock invariably exhibits majority of the following characteristics:

- Large Market Capitalization: Blue chip stocks are usually shares of large, well-established companies with a significant market capitalization. They typically have a market capitalization in the billions of dollars, indicating their substantial size and scale.

- Financial Stability: Blue chip companies possess solid financial foundations. They have strong balance sheets, with healthy cash reserves and manageable debt levels. They typically demonstrate steady revenue growth, consistent profitability, and have a history of generating positive cash flows.

- Industry Leadership: Blue chip stocks are leaders in their respective industries, holding a significant market share and enjoying a competitive advantage over their peers. They have established brand recognition and a reputation for quality products or services.

- Long Track Record: Blue chip stocks have a proven track record of performance and longevity. They have been operating for many years and have weathered various economic cycles while maintaining their market position.

- Dividend Payments: Many blue chip stocks pay regular dividends to their shareholders. These dividends are typically stable and may even grow over time, reflecting the company’s long-term financial strength and commitment to returning value to investors.

- Lower Volatility: Blue chip stocks tend to exhibit stability in their share prices, with lower volatility compared to smaller or riskier stocks. They may also demonstrate resilience during economic downturns, maintaining their performance even in challenging market conditions.

- Global Recognition: Blue chip companies are often recognized as household names and enjoy an excellent reputation among consumers and shareholders alike. Many of these companies have a global presence, with operations and revenue streams extending beyond their home countries.

- Inclusion in Major Indices: Blue chip stocks are usually components of major market indices (such as the S&P 500 or Dow Jones Industrial Average). This inclusion in major indices is an indication of their significance in the overall market.

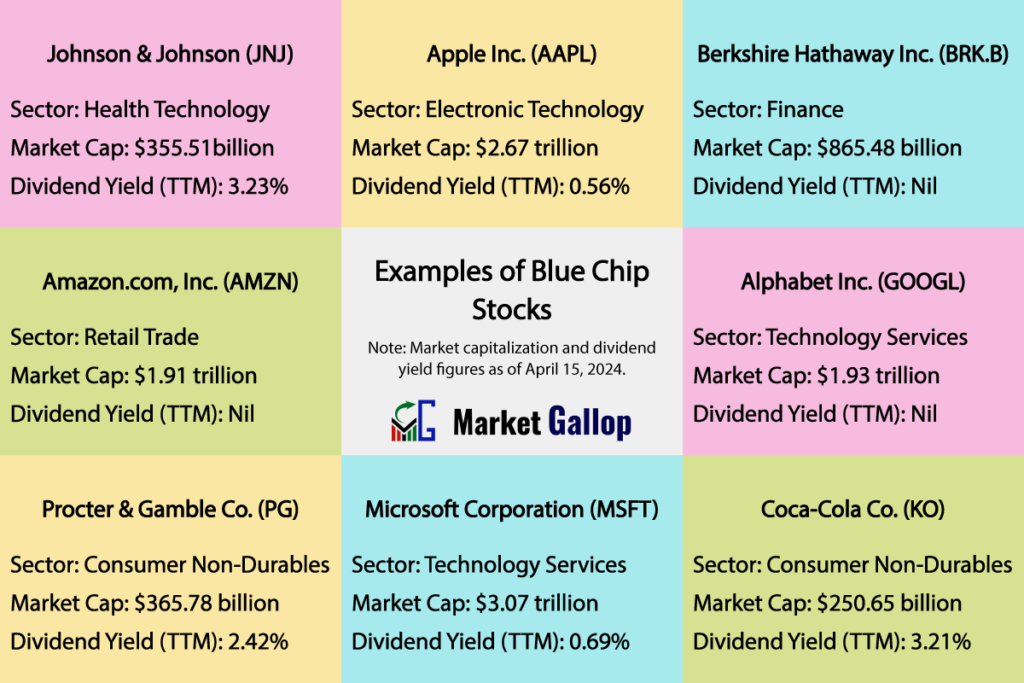

Examples of Blue Chip Stocks

One well-known example of a blue chip stock is Johnson & Johnson (JNJ), a multinational corporation based in New Jersey, United States. Founded in 1886, it has since grown into one of the largest and most diversified healthcare companies globally.

But why is it considered a blue chip stock? Johnson & Johnson is widely regarded as a quintessential blue chip stock due to its adherence to many of the key characteristics associated with blue chip companies.

Large Market Capitalization: Johnson & Johnson has a market capitalization of more than $350 billion as of April 2024, placing it among the top three companies in the health technology and pharmaceutical sectors in the U.S.

Longevity and Stability: Johnson & Johnson is one of the oldest and most established companies in the healthcare sector, with a history dating back over 135 years. It has demonstrated resilience through various economic cycles, making it a stable investment choice.

Strong Brand Recognition: Johnson & Johnson’s products are household names globally, including iconic brands like Band-Aid, Tylenol, Neutrogena, and Listerine. Its reputation for quality and reliability has earned it the trust of consumers worldwide.

Consistent Dividend Payments: Johnson & Johnson has a track record of consistently paying dividends to its shareholders for over five decades. The company is a constituent of the S&P 500 Dividend Aristocrats index and qualifies as a dividend king, having consistently increased its dividend payout for at least 50 consecutive years.

Robust Financial Performance: Johnson & Johnson is known for its strong financial position, with consistent profitability and a history of robust financial performance.

Inclusion in Major Indices: Johnson & Johnson is a component of major market indices such as the S&P 500.

Some other well-known examples of blue chip stocks include:

- Apple Inc. (AAPL)

- Berkshire Hathaway Inc. (BRK.A, BRK.B)

- Amazon.com Inc. (AMZN)

- Coca-Cola Co. (KO)

- Microsoft Corporation (MSFT)

- Procter & Gamble Co. (PG)

- Alphabet Inc. (GOOGL)

Risk and Return of Blue Chip Stocks

Blue chip stocks are generally considered to have a lower level of risk compared to smaller, less established stocks. The stability, reliability, and potential dividend income provided by these stocks make them appealing for those seeking a safer investment option. However, on the downside, these stocks may have lower growth potential compared to smaller, high-growth companies.

While they may not provide the same level of excitement as high-risk, high-reward stocks, they are favored by those who prioritize a more conservative and long-term approach. Other investors also often include blue chip stocks as a core component of a diversified portfolio, balancing the potential for returns with a focus on stability and income.

Risk

Lower Growth Potential: Blue chip stocks are typically mature companies with slower growth rates compared to smaller, high-growth companies. Though these stocks offer stability, they may not have the same growth potential as smaller, high-risk stocks. Investors seeking rapid capital appreciation, particularly over the short term, may find other investment options more appealing.

Valuation Concerns: Blue chip stocks, due to their reputation and perceived safety, often become overvalued, trading at higher price-to-earnings (P/E) ratios or price-to-book (P/B) ratios. Value investors, who prioritize assessing the intrinsic value of a stock while exploring investment opportunities, may struggle to find suitable opportunities in blue chip stocks.

Market Fluctuations: Blue chip stocks are still susceptible to market fluctuations and economic downturns. While they tend to be more resilient than smaller stocks during tough times, their prices can still be affected by broader market trends. Like any other stock, they may underperform during bear markets or periods of economic uncertainty.

Industry-Specific Risks: Blue chip stocks can be exposed to industry-specific risks. Changes in regulations, technological advancements, or shifts in consumer preferences can affect companies, even if they are considered blue chip.

Company-Specific Risks: While blue chip stocks belong to well-established companies, they can still face company-specific risks such as management changes, product recalls, or legal issues.

Return

Stability and Reliability: Blue chip stocks are known for their stability and reliability. These companies have a long history of dependable performance with strong balance sheets, consistent earnings, and well-established business models, making them relatively safer investments compared to smaller or riskier companies.

Dividend Income: Many blue chip stocks pay dividends regularly. These dividends can provide a steady income stream for investors, making them attractive for income-oriented investors, such as retirees or those seeking passive income. For many of these companies, these dividends grow over time, and some of them qualify as dividend aristocrats and dividend kings.

Long-Term Capital Appreciation: While blue chip stocks may not experience the same level of rapid growth as smaller, riskier stocks, they can still offer long-term capital appreciation. As these stocks are leaders in their respective industries and hold a significant market share, this leadership position can contribute to their long-term success. It means, over the long term, they provide investors with a reasonable return on investment.

Lower Volatility: Blue chip stocks generally exhibit lower volatility compared to smaller stocks. This lower volatility can make them more attractive to conservative investors seeking stability in their portfolios.

Resilience during Economic Downturns: Blue chip stocks tend to be more resilient during economic downturns compared to smaller, riskier stocks. Their established positions and financial strength often help them weather challenging economic conditions. Though there is no guarantee the stock price will not take a beating during such phases, they usually ride these challenges to bounce back strongly.

Blue Chip Stocks vs Penny Stocks

Blue chip stocks and penny stocks represent two ends of the spectrum in the stock market. As already discussed, blue chip stocks are shares of well-established, large-cap companies with a history of stability and consistent performance. On the other hand, penny stocks are shares of small companies with low market capitalization, often trading at a low price, typically below $5 per share.

While penny stocks may offer the potential for high returns, they also come with a high degree of risk and uncertainty. It’s estimated that only a small fraction of penny stocks actually succeed or experience significant long-term growth.

Examples of penny stocks include newly formed companies, speculative ventures, and companies that may be struggling financially. These stocks are often associated with higher risk due to factors such as low liquidity, lack of financial transparency, and susceptibility to manipulation.

| Criteria | Blue Chip Stocks | Penny Stocks |

|---|---|---|

| Definition | Shares of well-established companies with a long history of stable earnings, strong balance sheets, and reliable track records. | Shares of small companies with low market capitalization, trading at a low price, typically below $5 per share. |

| Characteristics | Financial stability, Dividend payments, Market leadership, Global recognition. | High volatility, Speculative nature, Lack of information, Susceptibility to manipulation. |

| Liquidity | Generally high liquidity with active trading volume. | Typically low liquidity with limited trading volume. |

| Risk and Return | Lower Risk, Moderate Return. | Higher Risk, High Potential Return. |

| Investor Profile | Conservative investors seeking stability and long-term growth. | Speculative investors looking for short-term gains. |

Blue Chip Stocks vs Large-Cap Stocks

Large-cap stocks, short for large-capitalization stocks, represent shares of companies with substantial market capitalization. Market capitalization is a measure of a company’s total value in the stock market and is calculated by multiplying the current stock price by the total number of outstanding shares. In the United States, stocks with market capitalizations exceeding $10 billion are considered large-cap.

While many blue chip stocks are indeed large-cap companies due to their significant market capitalization, not every large-cap stock meets the criteria to be classified as a blue chip. For instance, many large-cap stocks may lack the financial stability, industry leadership, or long-term track record of performance associated with blue chip status.