Cyclical stocks are a category of stocks that are particularly sensitive to economic cycles and tend to perform well when the overall economy is expanding but may face challenges during economic downturns. These stocks are linked to industries or sectors whose fortunes are closely tied to the business cycle, meaning the products or services offered by these industries experience fluctuations in demand based on economic circumstances.

What is a Cyclical Stock?

A cyclical stock is a stock whose performance is closely tied to the performance of the overall economy. These stocks are associated with industries that experience fluctuations in demand based on the prevailing economic conditions. As the overall economy expands or contracts, the demand for products and services from cyclical industries tends to follow suit.

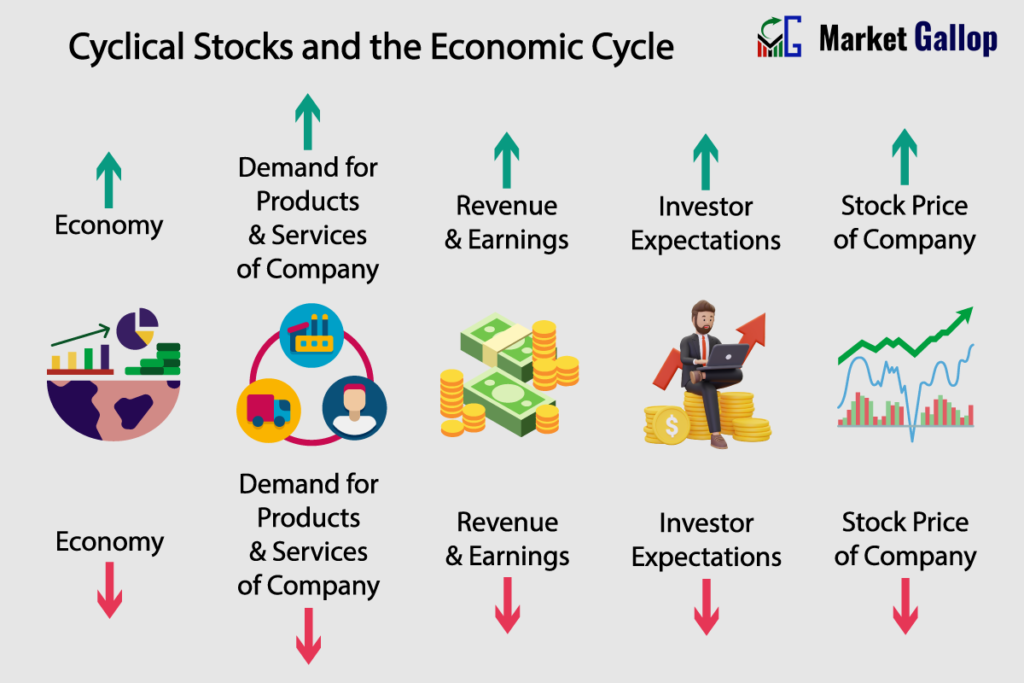

Cyclical stocks typically perform well when the economy is in an expansionary phase. They benefit from increased consumer spending and business investment during such prosperous times. As demand for their products or services increases, it leads to higher revenues, improved margins, and higher retained earnings for the company.

Conversely, these stocks can face challenges during economic downturns. When consumer spending and business investment decline, these consumer discretionary industries experience reduced demand. As sales decrease, it leads to lower revenues, lesser margins, and lower earnings.

Cyclical stocks exist in sectors that exhibit the above peculiarities, where the revenue and earnings of companies are dependent on the overall economic condition. As such, they are often found in industries such as manufacturing, construction, automotive, travel and leisure, and technology.

The stock prices of cyclical companies typically mirror changes in their financial position prompted by prevailing economic conditions. Investor expectations regarding future economic performance also influence price trends. For instance, positive economic news and indicators of strength can drive up the stock prices of cyclical stocks as investors anticipate higher sales, profits, and cash flows, and vice versa.

Cyclical Stock Definition

A cyclical stock is a stock of a company whose performance and stock prices are closely linked to the economic cycle. These stocks tend to rise and fall in line with the overall economy: during periods of economic expansion and rising consumer spending, cyclical stocks typically increase in value, whereas during economic downturns or recessions, when consumer spending declines, their value generally decreases.

Key characteristics that can be used to identify a cyclical stock include:

Revenue Volatility: The revenue of cyclical companies tends to be more volatile compared to companies in non-cyclical sectors. During economic booms, demand for their products or services increases, leading to higher revenues. Conversely, during economic downturns, demand may decrease, resulting in lower revenues.

High Beta: Due to their sensitivity to economic cycles, the stock prices of cyclical companies can be more volatile compared to those of non-cyclical or defensive stocks. Hence, these stocks often have higher beta coefficients, indicating greater sensitivity to market movements.

Correlation with Economic Indicators: Cyclical stocks tend to exhibit strong correlations with key economic indicators such as GDP growth, industrial production, consumer spending, and business investment.

Industry Sensitivity: Cyclical stocks are typically found in industries that are highly sensitive to changes in economic conditions, such as manufacturing, construction, automotive, travel and leisure, and technology.

How do Cyclical Stock Work?

Cyclical stocks are particularly sensitive to economic fluctuations because they are usually associated with industries whose performance is heavily influenced by consumer spending patterns.

Consider a period of economic prosperity, where job growth is strong, wages are rising, and consumer confidence is high. During such times, individuals often have more disposable income, leading to increased spending on non-essential or discretionary items like new cars, home renovations, vacations, luxury goods, and dining out. Thus, companies operating in these sectors experience increased demand for their products and services. This translates to higher revenues, improved profitability, and often, rising stock prices.

Conversely, during economic downturns or recessions, when job security is uncertain and consumer confidence declines, individuals tighten their budgets and prioritize essential expenses over discretionary purchases. Spending on non-essential items declines, leading to decreased demand for goods and services offered by cyclical industries. Declining revenues and profitability can lead to decreased stock prices for companies in these sectors.

Let’s take the example of an automotive manufacturer. During periods of economic prosperity, when consumer spending is robust, the demand for new cars tends to surge. This translates into higher sales volumes and revenues for the automotive company, boosting its profitability and driving up its stock price.

Conversely, during economic downturns, consumers may postpone or scale back purchases of new cars, opting to repair existing vehicles or delay upgrades. This reduction in demand negatively impacts the financial performance of the automotive manufacturer, leading to lower revenues and profitability. Consequently, the stock price of the company may decline as investors anticipate weaker earnings.

Example of a Cyclical Stock

A notable example of a cyclical stock is Ford Motor Co (F). Ford operates in the automotive industry, which is considered cyclical. The financial performance of Ford tends to reflect the broader economic cycles. For example, during periods of economic growth, Ford may experience higher sales and profits. However, during economic downturns, the demand for cars may decline, affecting Ford’s financial performance.

Some other examples of cyclical stocks include:

- Caterpillar (CAT): Caterpillar is a leading manufacturer of construction and mining equipment, engines, and industrial turbines.

- Nucor (NUE): Nucor Corporation is one of the largest steel producers in the United States.

- Boeing (BA): Boeing is a major aerospace company that designs, manufactures, and sells commercial airplanes, military aircraft, satellites, and related aerospace products and services.

- Hyatt Hotels (H): Hyatt Hotels Corporation operates a portfolio of hotel and resort properties worldwide.

Cyclicality vs Seasonality

As discussed above, cyclical stocks and their performance are closely tied to economic cycles. However, this is not to be confused with seasonality, which refers to shorter-term patterns influenced by specific seasons or recurring events within certain industries. Let’s elaborate.

Cyclicality refers to the tendency of their performance to fluctuate in line with broader economic cycles. These cycles are driven by broader macroeconomic factors such as changes in GDP growth, interest rates, consumer spending, and business investment.

On the other hand, seasonality refers to the tendency of an asset or economic indicator to exhibit repetitive patterns or fluctuations within shorter timeframes, typically tied to specific seasons or recurring events. These patterns are influenced by factors such as weather, consumer behavior, and cultural or religious events.

Seasonality can affect various assets, including agricultural commodities, retail businesses, tourism-related industries, and energy markets. For example, the holiday shopping season, particularly during November and December, sees a surge in retail sales as consumers purchase gifts for various holidays such as Thanksgiving, Christmas, and New Year’s Eve. In the automotive industry, sales tend to be higher during certain times of the year, such as the end of the year when new car models are released or during periods of promotional sales events. Similarly, the travel and leisure industry may experience higher demand during peak vacation seasons.

Risk and Return of Cyclical Stocks

Cyclical stocks offer the potential for high returns during economic expansions. As the economy grows, demand for cyclical industries increases, leading to higher sales and profits for companies in these sectors.

However, they also carry inherent risks tied to economic conditions. During periods of economic contraction, demand for cyclical products and services tends to decline, resulting in lower sales, revenues, and profitability for cyclical companies. This can lead to significant declines in stock prices and investor returns.

Successful investment in cyclical stocks requires taking advantage of market timing opportunities, buying when the economic outlook is positive, and selling before economic downturns.

Furthermore, maintaining a balanced portfolio that includes both cyclical and non-cyclical stocks is crucial for managing overall risk. Non-cyclical or defensive stocks, such as those in healthcare or utilities, can provide stability during economic downturns.

Risk

Economic Sensitivity: The primary risk associated with cyclical stocks is their sensitivity to economic cycles. During economic contractions or recessions, these stocks may face reduced demand, leading to lower sales and profitability, which may lead to negative investor sentiment and falling stock prices.

Volatility: Cyclical stocks tend to be more volatile than non-cyclical or defensive stocks. Their performance can be influenced by economic indicators, interest rates, and consumer sentiment, contributing to price fluctuations.

Financial Leverage: Some cyclical industries, such as manufacturing and capital-intensive sectors, may use financial leverage to fund operations. While leverage can amplify returns during good times, it also increases financial risk during economic downturns.

Market Timing: Successfully investing in cyclical stocks often requires accurate market timing. It can be challenging to predict the turning points in economic cycles, and mistimed investments may lead to suboptimal returns.

Sector Concentration: Investing heavily in cyclical stocks can result in sector concentration risk. To mitigate this, investors may need to diversify their holdings across various sectors.

Return

High Return during Economic Expansion: Cyclical stocks often have the potential for high returns during economic expansions. As the economy grows, demand for cyclical industries, such as technology, manufacturing, and travel, tends to increase, leading to higher sales and profits for companies in these sectors. This typically bring about positive investor sentiment and rising stock prices.

Contrarian Opportunities: Economic cycles create opportunities for contrarian investing in cyclical stocks. During economic downturns, cyclical stocks may be undervalued as investors flee riskier assets. By buying cyclical stocks at low prices during downturns, investors can potentially benefit from a rebound in economic activity and stock prices during subsequent recoveries.

Recovery Potential: During economic recoveries, cyclical stocks have the potential to rebound strongly as economic conditions improve and demand for their products and services picks up. This recovery phase can lead to significant share price appreciation for cyclical companies that have weathered the downturn and positioned themselves for growth.

Diversification Benefits: Including cyclical stocks in a diversified portfolio can enhance overall portfolio returns, especially during periods of economic expansion.

Cyclical Stock Sectors

Cyclical stocks are associated with sectors that tend to be sensitive to economic cycles. Here are some common cyclical stock sectors:

1. Automotive

The automotive sector, including companies involved in the production of cars, trucks, and related components, is highly cyclical. Consumer demand for new vehicles is closely tied to economic conditions.

2. Construction and Real Estate

Construction and real estate industries are cyclical, with demand for new homes, commercial buildings, and infrastructure projects influenced by economic cycles.

3. Consumer Discretionary

This sector includes industries such as retail, leisure, and entertainment. Consumer spending on non-essential goods and services tends to rise during economic expansions.

4. Financials

Financial companies, including banks, insurance companies, and financial advisory firms, are also sensitive to economic cycles. During periods of economic growth, demand for financial products and services such as loans, mortgages, and investment advice tends to increase.

5. Travel and Leisure

Companies involved in travel, tourism, and leisure activities are cyclical. People are more likely to spend on vacations and leisure during economic booms.

6. Industrial Goods

Industries producing capital goods, machinery, and equipment fall into the cyclical category. Increased industrial activity is associated with economic growth.

7. Technology

Many segments within the technology sector can exhibit cyclical characteristics. For example, companies that provide enterprise software or IT services may experience fluctuations in demand tied to broader economic cycles. Similarly, companies dealing with consumer electronics products and other hardware products are considered cyclical. Demand for these tech products and services usually correlates with economic growth.

8. Manufacturing

Majority of manufacturing activities are highly sensitive to changes in economic conditions. During periods of economic expansion, when GDP growth is strong, consumer demand is high, and business investment is robust, manufacturing output tends to increase as companies produce more goods to meet rising demand. There are exceptions though, such as segments catering to manufacturing of essential items and other niche markets such as defense.

9. Materials

Basic materials industries, including mining, metals, and chemicals, are cyclical. Demand for raw materials and commodities is influenced by economic conditions.

10. Transportation

The transportation sector, including airlines and shipping companies, is cyclical. Demand for transportation services is influenced by economic activity.

It’s important to note that while these sectors are generally considered cyclical, individual companies within each sector may have unique characteristics and may be affected differently by economic cycles. Additionally, the classification of a stock as cyclical is a simplification, and other factors such as company-specific dynamics and global events can also impact stock performance.

Cyclical Stocks vs Defensive Stocks

Defensive stocks refer to shares of companies whose performance is considered resilient during economic downturns or periods of market volatility. These stocks are associated with industries that provide essential goods and services that consumers continue to use or demand, regardless of the overall economic conditions.

Unlike cyclical stocks which are closely tied to economic cycles, defensive stocks are known for their stability during economic downturns.

The performance of defensive stocks is less influenced by economic cycles and more driven by factors such as company fundamentals and the stability of their cash flows. Unlike cyclical companies, the revenue and earnings of these companies tend to remain relatively stable regardless of the prevailing economic conditions.

Defensive stocks typically exhibit lower volatility compared to cyclical stocks. While they offer lower potential returns compared to cyclical stocks, they also come with lower risk, making them appealing to conservative investors.

Industries traditionally considered defensive include utilities, healthcare, and consumer staples. These sectors often comprise companies offering products or services that people require regardless of economic conditions. For instance, demand for utilities and consumer staples remains relatively stable, and healthcare is essential regardless of economic conditions. Conversely, industries such as manufacturing, technology, automotive, and travel and leisure are deemed cyclical, with demand for their products and services fluctuating with economic conditions.

Investors typically seek cyclical stocks when the economic outlook is positive and expansion is expected. Conversely, they may consider investing in defensive stocks as a protective measure during economic downturns or uncertainty.

| Aspect | Cyclical Stocks | Defensive Stocks |

|---|---|---|

| Sensitivity to Economic Conditions | Prosper in economic expansions. | Resilient during economic contractions. |

| Goods and Services Provided | Non-essential category. | Essential category. |

| Examples of Industries | Real estate, automotive, travel & leisure. | Utilities, healthcare, consumer staples. |

| Performance Factors | Influenced by economic indicators (GDP, etc.). | Less influenced by economic cycles. |

| Volatility | Higher volatility, susceptible to economic trends. | Lower volatility, more stability. |

| Risk and Return | High potential returns, higher risk. | Lower potential returns, lower risk. |

| Investment Strategy Considerations | Suitable for economic growth periods. | Suitable as defensive holdings in downturns. |

| Investor Goals | Attractive for higher returns, higher risk tolerance. | Suitable for conservative investors prioritizing stability. |