The Three White Soldiers is a bullish reversal candlestick pattern that occurs in technical analysis, indicating a potential reversal of a downtrend. This pattern consists of three consecutive bullish candlesticks, each with progressively higher closing prices.

The Three White Soldiers pattern suggests that buyers have gained control over the market and are overpowering the sellers. The increasing buying momentum indicated by the consecutive higher closes signifies a shift in sentiment from bearish to bullish.

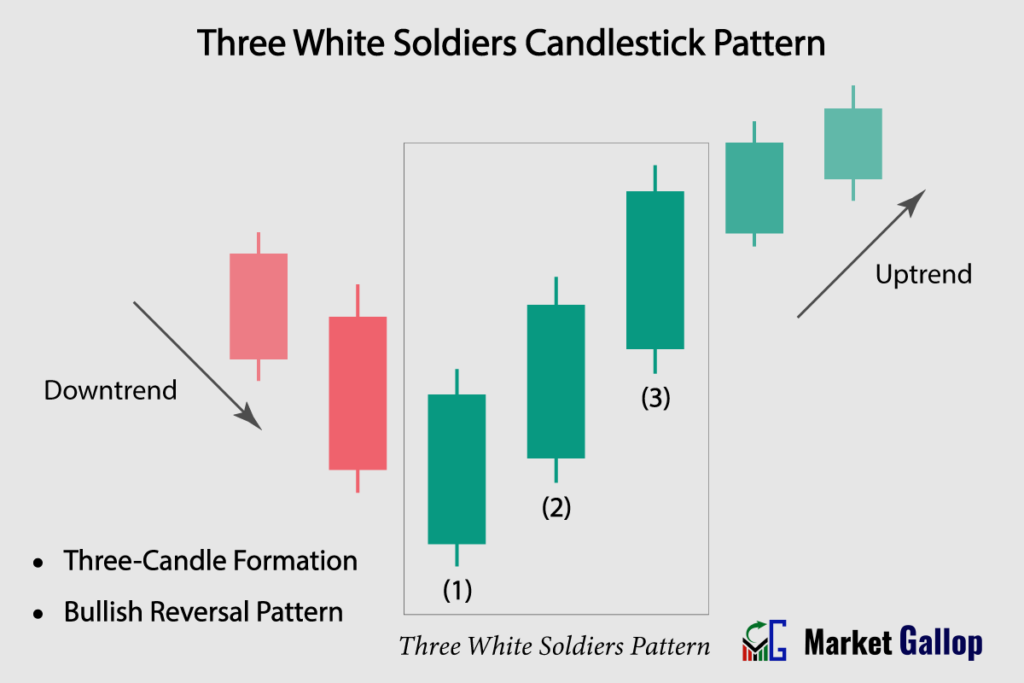

Three White Soldiers Candlestick Pattern

The Three White Soldiers Candlestick Pattern is a three-candle pattern that often indicates a potential bullish reversal following a downtrend or a phase of sideways movement within the downtrend.

The Three White Soldiers pattern is characterized by a series of three strong, and relatively large bullish candles with consecutively higher closes. This pattern is recognized as a strong reversal signal and indicates a potential shift from a downtrend to an uptrend in the market.

Three White Soldiers Pattern – Formation

The Three White Soldiers pattern is a three-candle reversal formation.

First Candlestick (Bullish): The first candlestick is a bullish (green) candle that closes near its high price of the day. It suggests that buyers have entered the market and are able to push the price higher from the opening level.

Second Candlestick (Bullish): The second candlestick typically opens within the body of the previous candle and closes higher, near its high of the day. It demonstrates a continuation of buying momentum from the previous session.

Third Candlestick (Bullish): The third candlestick follows a similar pattern. It typically opens within the body of the second candle and closes near its high. This candlestick reaffirms the buying pressure, indicating strong demand for the asset.

Rules of Identification

Prior Trend: The market should either be in a clear downtrend or in a period of sideways momentum within the downtrend before the Three White Soldiers pattern occurs.

Three Consecutive Bullish Candlesticks: Look for three consecutive bullish candlesticks on a price chart.

First Candle: The first candle should be a bullish (green) candlestick. The candle must close at or near its highs, with relatively small or no lower shadows.

Second Candle:The second candle should be a bullish (green) candlestick and typically opens within the body of the first candle. However, an open a little higher than the previous candle’s body is also valid. The candle must close at or near its highs, with relatively small or no lower shadows.

Third Candle: The third candle should be a bullish (green) candlestick and typically opens within the body of the second candle. Like the previous candle, an open a little higher than the previous candle’s body is also valid. The candle must close at or near its highs, with relatively small or no lower shadows.

Color:The color of the first, second and third candles must be green.

Strong Upward Movement: Each of the three candlesticks should display a significant upward movement, with relatively small or no lower shadows.

Higher Closes: Each candlestick should close at or near its high price of the day, reflecting sustained buying pressure.

Shadows: Each of the bullish candles must close at or near its highs, which means either there are no shadows on the upper side, or shadows, if present, are normally small. Small shadows on the downside can be neglected.

Market Psychology

The Three White Soldiers pattern reflects a consistent pattern of increasing prices and is a clear indication of a change in market sentiment. It suggests that the bears (sellers) are losing control, and the bulls (buyers) are taking charge. Each candlestick’s higher closing price and smaller shadows convey a sense of optimism and confidence among buyers.

The first candlestick, which opens and closes in bullish territory near its high, indicates the halt in the selling momentum. This signifies that buyers are actively participating and have managed to push the price higher compared to the opening level. This initial surge in buying activity establishes a foundation for the subsequent trend.

The second candlestick extends the bullish sentiment. Its opening typically occurs within the body of the previous candle, indicating that the buying momentum from the first session is spilling over. As the candle progresses, it achieves a higher closing price near its daily high. This progression signifies that the upward momentum is being sustained, as buyers remain engaged and determined.

The third candlestick mirrors the trajectory of its predecessors. Opening within the range of the second candle, it reinforces the theme of bullish continuation. Its upward journey culminates in a closing price that hovers near the high of the day. This closing level near the high points to a strong commitment from buyers and a prevailing bullish sentiment.

How to Trade Three White Soldiers

- Identify the Downtrend: Before looking for the Three White Soldiers pattern, make sure there is a clear and established downtrend in the price chart. In some instances, the market may exhibit sideways behavior within the downtrend, without violating the downtrend.

- Wait for a Three White Soldiers Pattern to Emerge: Wait for the completion of candles 1, 2, and 3.

- Entry: Observe the behavior of the third bullish candle. Entry is triggered at the third bullish candle. However, more conservative traders should wait for third candle to close. Entry is confirmed at the close of third bullish candle. There might be a slight price pullback after the third candle. Some traders may choose to wait for these pullbacks to secure a better entry point. However, pullbacks may not occur in all instances.

- Set Stop-Loss: Traders may set stop-loss below the low of the first bullish candle, i.e., candle 1.

Traders are advised to utilize additional technical analysis tools, including key support levels, trendlines, volume analysis, and technical indicators, to validate the potential reversal indicated by the Three White Soldiers pattern. Employing these tools helps diminish the risk of false signals and bolsters the overall reliability of the pattern.

Trigger: When the third candle exhibit satisfactory bullish behavior.

Confirmation: At the close of third bullish candle.

Stop-loss: Just below the low of the entire Three White Soldiers pattern.

Reliability of the Pattern

Make sure that the Three White Soldiers pattern appears after a prolonged downtrend. This increases the pattern’s reliability as a bullish reversal signal.

Patterns that appear on longer timeframes, such as the weekly or monthly charts, are more reliable. It’s advisable to remain vigilant for these patterns emerging near significant key support levels.

Remember that while the pattern can be a reliable bullish reversal signal, no pattern works 100% of the time. Like any other candlestick pattern, this pattern can also produce false signals. Always consider the overall market context, use proper risk management techniques, and be prepared for unexpected market movements.

To elevate the reliability of the Three White Soldiers pattern, consider combining it with additional technical analysis tools such as support levels, trendlines and technical indicators.

Gallop Insights

For better results:

- Look for Three White Soldiers pattern at key levels (support & resistance levels)

- Wait for confirmation of pattern, i.e., close of the third bullish candle.

- The pattern should not be used in isolation. Use it in conjunction with other technical analysis tools and indicators.