A market order is a type of order placed by an investor to buy or sell a security at the prevailing market price. Market orders prioritize speed of execution over price. This means that the order is filled as quickly as possible at the best available price in the market. Despite the inherent risk of uncertain execution prices associated with them, they are favored by traders who seek immediate execution of orders.

What is a Market Order?

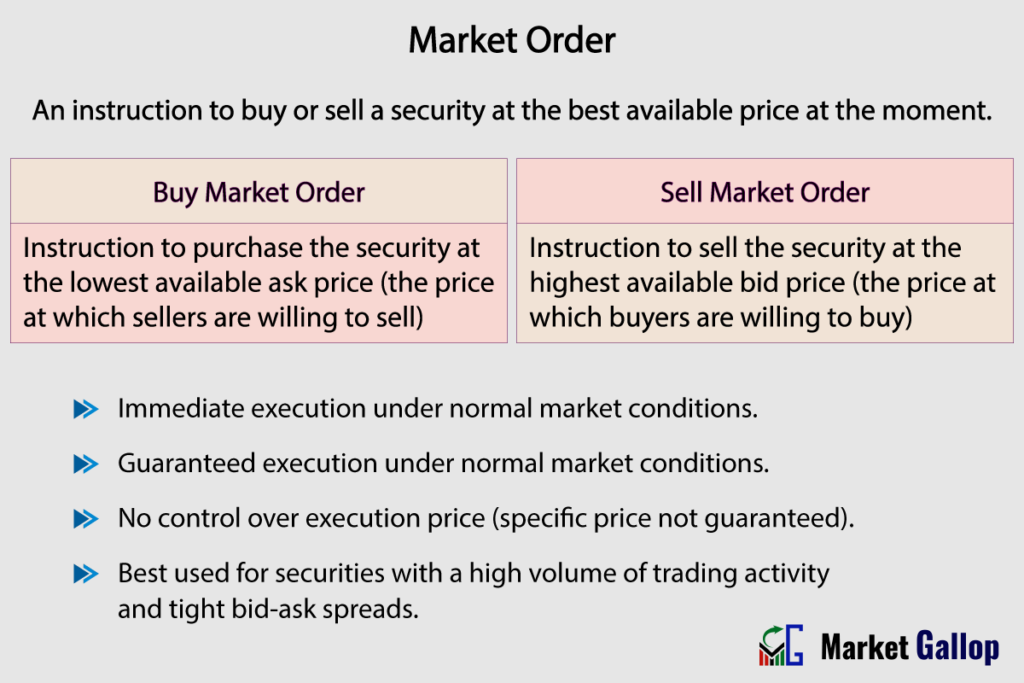

A market order is an instruction to buy or sell a security at the best available price in the market at that moment. For a buy market order, the investor will purchase the security at the lowest available ask price (the price at which sellers are willing to sell). For a sell market order, the investor will sell the security at the highest available bid price (the price at which buyers are willing to buy).

Market orders are simple and straightforward, requiring only the specification of the security to be traded and the desired quantity. There is no need to specify a price, as the order is executed at the best available price in the market. These orders are executed as soon as possible after they are submitted to the market, often within seconds. The exact execution time, though, may vary depending on market conditions, trading volume, and the liquidity of the security being traded.

Buy Market Order: A buy market order is an instruction to purchase a security at the best available price in the market. The execution of a buy market order occurs at the prevailing ask price in the market. The ask price is the price at which sellers are willing to sell the security.

Sell Market Order: A sell market order is an instruction to sell a security at the best available price in the market. The execution of a sell market order occurs at the prevailing bid price in the market. The bid price is the price at which buyers are willing to buy the security.

One notable disadvantage of market orders is that investors have no control over the price at which their order is filled. Hence, these orders are often subject to price slippage. Price slippage occurs when the execution price differs from the quoted price at the time of order placement, especially in fast-moving markets or during periods of low liquidity.

Market orders are most commonly used for trading highly liquid securities, such as selected large-cap stocks or popular ETFs, where there is a high volume of trading activity and tight bid-ask spreads. In these markets, the difference between the bid and ask prices is usually minimal, reducing the potential impact of market order execution on the final price.

How a Market Order Works?

When a trader places a market order, they are essentially requesting immediate execution of the trade at the best available price in the market.

The market order is matched with existing buy or sell orders in the market. If the trader is buying, the order is matched with existing sell orders (asks) at the lowest available ask price. If the trader is selling, the order is matched with existing buy orders (bids) at the highest available bid price.

Buy Market Order

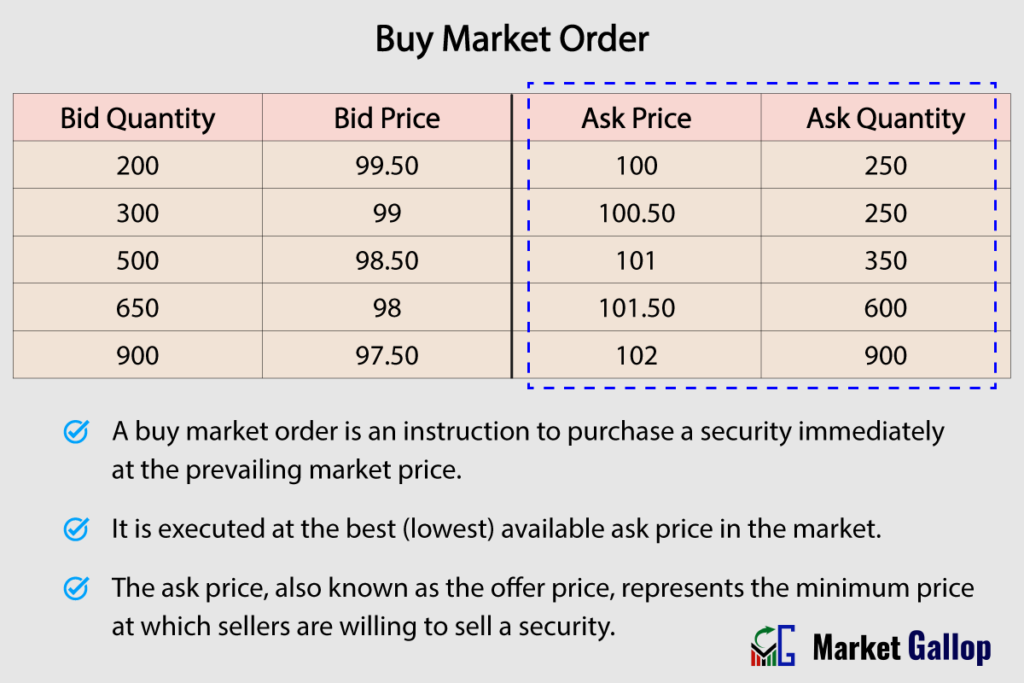

A buy market order is an instruction given by an investor to purchase a security immediately at the prevailing market price. When a buy market order is placed, the investor is willing to pay the current ask price, which is the lowest price at which sellers are willing to sell the security. The order is executed as soon as possible at the best available ask price in the market.

Consider the following example using Amazon (AMZN) stock for illustrative purposes. The table below presents a fictitious bid-ask order book for AMZN. On the left-hand side are the bid prices, indicating the prices at which buyers are willing to purchase shares, along with the corresponding total quantity of shares they are willing to buy at each bid price level. On the right-hand side are the ask prices, showing the prices at which sellers are willing to sell shares, along with the corresponding quantity.

Suppose an investor, Alice, wishes to buy 100 shares of Amazon stock. She places a buy market order through her brokerage platform for 100 shares of AMZN. The brokerage executes her order immediately at the best available ask price in the market. According to the above table, the best ask price at the time of order execution is $100 per share. Alice’s buy market order will be filled at that price. She will purchase 100 shares of AMZN at $100 per share, and the total cost will be $10,000.

But what if Alice wishes to buy more, let’s say 500 shares of AMZN? There are only 250 shares available at the ask price of $100 per share at the time of order execution. Then the remaining 250 shares will need to be purchased at the next best available ask price. According to the above bid-ask order book, there are another 250 shares available at $100.50 per share. In this scenario, the brokerage will purchase 250 shares at $100 per share, and the remaining 250 shares at $100.50 per share. The total cost will be $50,125 at an average price of $100.25 per share.

Sell Market Order

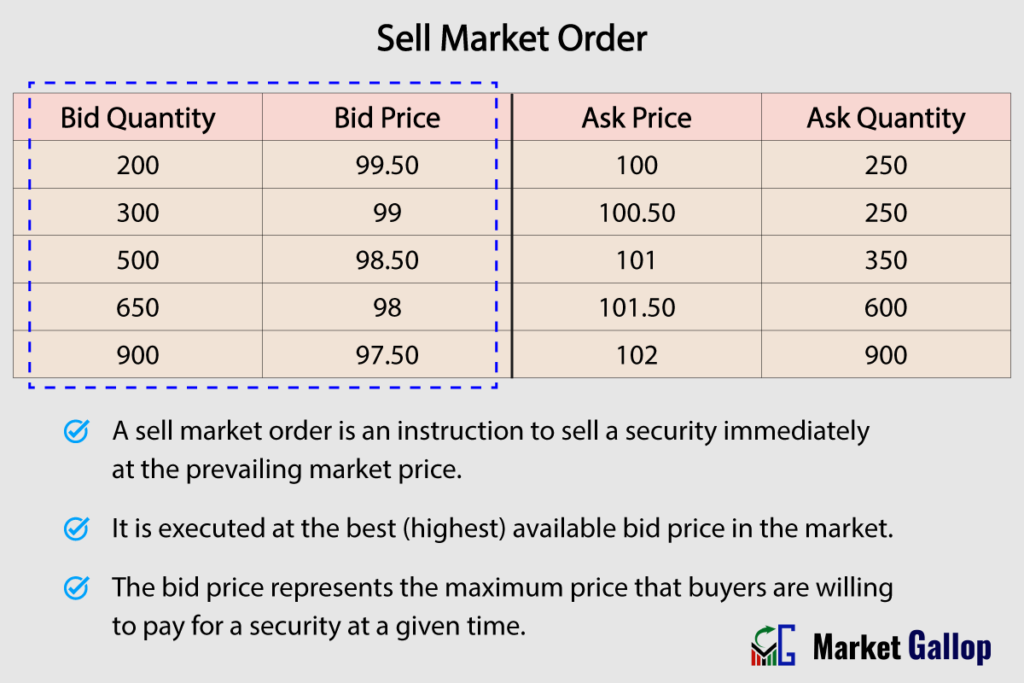

A sell market order is an instruction given by an investor to sell a security immediately at the prevailing market price. When a sell market order is placed, the investor is willing to accept the current bid price, which is the highest price at which buyers are willing to purchase the security. The order is executed as soon as possible at the best available bid price in the market.

Let’s consider the same example as above. The same table is re-quoted below.

Suppose another investor, Bob, owns shares of Amazon stock (AMZN) and wants to sell 100 shares. Bob places a sell market order through his brokerage platform for 100 shares of AMZN. The brokerage will execute his order immediately at the best available bid price in the market. According to the above bid-ask order book, the best bid price at the time of order execution is $99.50 per share. Bob’s sell market order will be filled at that price. He will sell 100 shares of AMZN at $99.50 per share, resulting in total proceeds of $9,950.

However, what if Bob wishes to sell 500 shares of Amazon? There are only 200 buyers willing to purchase at the bid price of $99.50 per share at the time of order execution. Then the remaining 300 shares will need to be sold at the next best available bid price. As per the above bid-ask order book, another 300 buyers are willing to purchase at $99 per share. In this scenario, the brokerage will sell the 200 shares at $99.50 per share and the remaining 300 shares at $99 per share. Bob receives a total amount of $49,600, at an average price of $99.20 per share.

Market Orders & Securities with Wide Bid-Ask Spreads

Market orders can pose risks when trading securities with wide bid-ask spreads. A bid-ask spread represents the difference between the highest price a buyer is willing to pay (bid) and the lowest price a seller is willing to accept (ask) for a security.

As you know, market orders are filled at the best available price in the market. For securities with wide bid-ask spreads, this means that market orders may be executed at prices significantly higher than the bid price when buying or significantly lower than the ask price when selling. As a result, traders may end up paying more for securities than anticipated or receiving less when selling, leading to larger transaction costs. These costs can erode potential profits or exacerbate losses for a trader, especially for those involved in scalping and day trading.

For example, suppose a trader wants to buy 1000 shares of a less liquid stock, XYZ Corp, which has a wide bid-ask spread. The current bid price for XYZ is $32.50 per share, and the ask price is $34.50 per share. The bid-ask spread, in this case, is $2.00 ($34.50 – $32.50).

So in this case, the trader places a market order to buy 1000 shares of XYZ without considering the bid-ask spread. However, since these orders prioritize immediate execution at the prevailing market price, the order is filled at the best available ask price, which is $34.50 per share. So at the best-case scenario, the trader ends up paying $34.50 per share for XYZ, even though the bid price was only $32.50 per share. But it can also get worse. What if 1000 shares are not available at the ask price of $34.50? In that case, the remaining shares are filled at the next best available ask price, let’s say $35.50. So the trader ends up paying even more than $34.50 per share for XYZ.

The risk with market orders for securities with wide bid-ask spreads is that traders may end up paying significantly more (or receiving significantly less when selling) than the current market price due to the gap between the bid and ask prices. This can lead to increased transaction costs and reduced profitability for traders.

To mitigate this risk, traders should consider using limit orders instead of market orders for securities with wide bid-ask spreads. Limit orders allow traders to specify the maximum price they are willing to pay when buying or the minimum price they are willing to accept when selling. This provides more control over execution prices and reduces the impact of wide bid-ask spreads on trading outcomes.

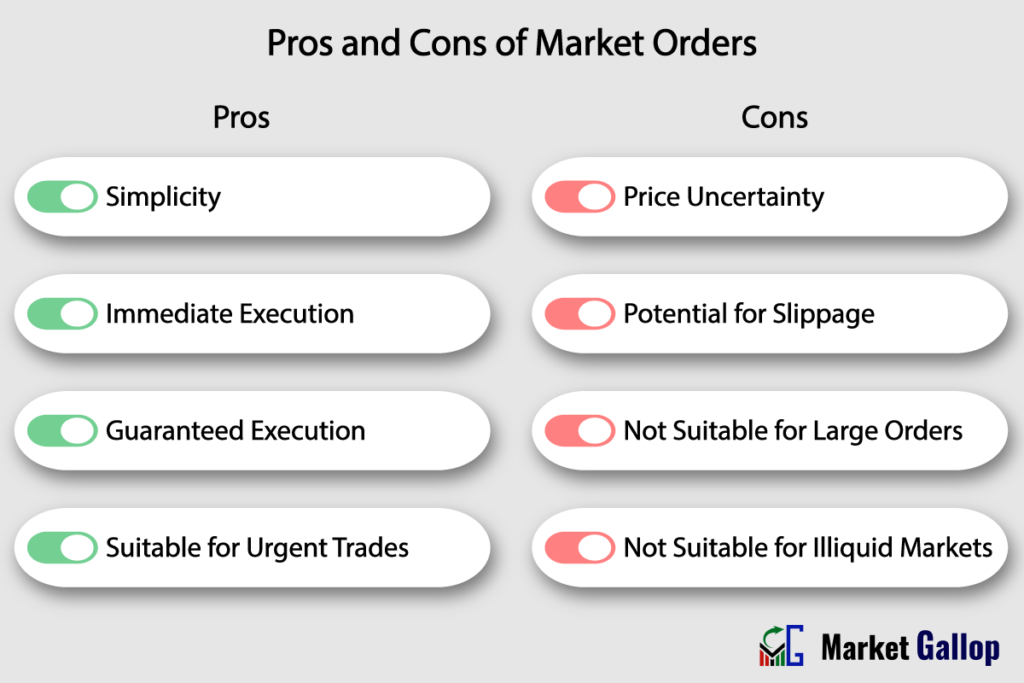

Advantages of a Market Order

- Simplicity: Market orders are simple and straightforward to use. Traders only need to specify the security they want to trade and the quantity, without needing to set a specific price.

- Immediate Execution: Market orders are executed promptly under normal market conditions, usually within seconds of being placed. This ensures that the trade is completed swiftly, allowing traders to enter or exit positions without delay.

- High Probability of Execution: Among different order types, market orders have the highest likelihood of being filled since they are executed at the prevailing market price. This makes them particularly useful in highly liquid markets where there is ample trading activity.

- Effectiveness in Liquid Markets: Market orders are most effective in liquid markets with tight bid-ask spreads. In such markets, there is minimal price slippage, and orders are typically filled at prices close to the prevailing market quotes.

Risks of a Market Order

- Price Variability: Market orders prioritize speed of execution over price, which means that the exact execution price may differ from the quoted price at the time of order placement.

- Inadequate Liquidity: These orders may face challenges in illiquid markets or for securities with wide bid-ask spreads. In such situations, traders may experience difficulty in obtaining favorable execution prices.

- Unintended Execution: Due to their immediate execution nature, market orders are vulnerable to accidental or unintended trades. Traders must exercise caution when placing market orders to avoid unintended positions or excessive trading activity.

- Increased Risk of Slippage: Market orders are susceptible to slippage, where the final execution price differs from the intended price due to rapid price movements or insufficient liquidity. This may lead to unfavorable execution prices and can erode potential profits or amplify losses, particularly for large or market-moving orders.

Suppose a trader wants to buy 1000 shares of Tesla (TSLA) stock at the current market price. The last quoted price for Tesla is $200 per share. The trader decides to place a market order to ensure immediate execution.

However, just before the trader’s market order is executed, there is a sudden surge in buying activity in the market due to positive news about the company. As a result, the price of Amazon rapidly increases from $200 to $202 per share within seconds.

Since these orders are executed immediately, the trader’s order is filled at the best available price in the market, which is now $202 per share. Despite intending to buy Tesla at $200 per share, the trader ends up paying $202 per share due to the sudden price movement.

This difference between the intended price ($200) and the actual execution price ($202) represents slippage. In this scenario, the trader experiences slippage of $2 per share, resulting in a higher cost than initially anticipated. The total slippage for 1000 shares is $2000, which is by no means a small amount.

Market Order vs Limit Order

As discussed above, traders and investors use market orders when they want to enter or exit a position immediately. However, the biggest drawback of these orders is that traders cannot specify or control the exact price at which the trade is executed. This is where a limit order becomes advantageous. Limit orders allow traders to specify the exact price at which they are willing to buy or sell.

A limit order is a type of order to buy or sell a security at a specified price or better. When placing a limit order, traders set a price at which they are willing to buy (for a buy limit order) or sell (for a sell limit order). The order will only be executed if the market price reaches the specified limit price or better.

| Aspect | Market Order | Limit Order |

|---|---|---|

| Execution Guarantee | Guaranteed under normal market conditions | Not guaranteed, execution depends on market reaching limit price |

| Execution Speed | Immediate | May not be immediate, depends on price reaching limit |

| Price Certainty | Uncertain (executed at prevailing market price) | Certain (executed at specified price or better) |

| Order Placement | No need to specify price | Specify price to trigger execution |

| Market Impact | May cause slippage due to market conditions | Less likely to cause slippage |

| Strategy Suitability | Suitable for urgent trades requiring immediate execution | Suitable for planned trades with specific price targets |